Abolish the income tax, cut em loose, and promote MAFI

Trump is falling down the rabbit hole of big government. Tariffs are the hallmark of state capitalism. Must read essay in the WSJ today (see below).

When the income tax went into effect in 1913, about 98% of the American people did not have to pay the direct tax. (That’s the major reason it was popular.)

The tax rates ranged from 1 to 7 percent, and the first 1040, including instructions, was only four pages long. The current 1040 instructions contain more than 100 pages.

This begs the question, why should paying federal income taxes be more complicated than paying your cable bill, groceries, rent or mortgage, etc.? In addition, what should be the “correct” income tax rate in a free society? The short answer is zero, as I asserted in my first book, Tax Free 2000: The Rebirth of American Liberty.

In effect, I was echoing Thomas Jefferson’’s observation in his first inaugural address: “…a wise & frugal government, which shall restrain men from injuring one another, shall leave them otherwise free to regulate their own pursuits of industry and improvement, & shall not take from the mouth of labor the bread it has earned. this is the sum of good government...”

Nearly a half a century latter in France, Frederic Bastiat made a similar assertion: “…man can live and satisfy his wants by seizing and consuming the products of the labor of others. This process is the origin of plunder.”

Taxation = Plunder.

Unfortunately, most American cannot imagine of living in a tax free world, having been bamboozled by the political class, pundits, academics, and other apologists that the welfare-warfare state is compatible with the contemporary version of “American values,” but in reality is in conflict with the Declaration of Independence.

The Declaration is clear: “We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.--

Life, Liberty and the pursuit of Happiness can mean only one thing: The freedom to keep the fruits of one’s labor to achieve our peaceful goals. Period. In short, a tax free America.

What about “government services”? As Murray Rothbard’s essay points out, the public sector is counterproductive and a gross violation of individual rights. The welfare-warfare state is thus incompatible with a free society.

To begin the transition to a free society, Trump should call for the end of all federal “aid” to private business…no more corporate welfare. End all aid to states, counties, school districts, and local governments. Eliminate all aid to colleges and universities. Decentralize. Decentralize. And here is the big one: abolish foreign aid and all military aid around the world.

Trump is falling down the rabbit hole of big government. Tariffs are the hallmark of state capitalism. Must read in the WSJ today.

Ending most federal government spending is consistent with the Tenth Amendment, “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.”

In addition, abolishing spending that causes contentious politics and lawsuits would fulfill Jefferson’s admonition: “To compel a man to furnish funds for the propagation of ideas he disbelieves and abhors is sinful and tyrannical.”

Freedom of conscience is a bedrock of America’s soul.

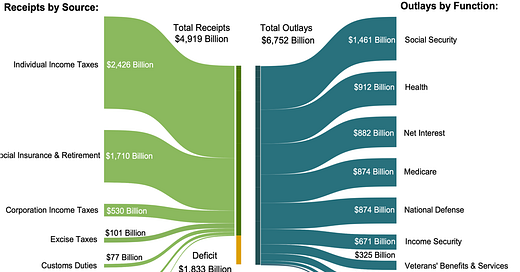

These savings would balance the budget at $5 trillion eliminating the deficit by $2 trillion. The 2024 federal budget (ended September 30, 2024) below reveals the mega categories that DOGE should cut based on the above suggestions.

This would put America on the road to a free society as the next step would be to reduce taxes in transitioning to a tax free America. In short, the unfinished agenda of the American Revolution is MAFI—Making Americans Financially Independent. Who could be possible be against being an independent adult?

*******************************************************************************************************

Dave Campbell and I discuss MAFI on the Clarity and Chaos podcast.

Col. Mike and Dr. Mike and I discuss Trump and his promises on the National Security Hour.

*********************************************************************************************************

Restoring free enterprise, medical freedom, and a constitutional federal budget.

The insufferable Jim Cramer reveals his economic ignorance in a recent CNBC rant.

*********************************************************************************************

You can reduce your taxes, keep more of your income, and increase your financial independence if you are self-employed and/or have a home based business. The Home Office Tax Kit is invaluable to reduce your taxes as we approach April 15th. This is our first affiliate marketing relationship. Future links will provide you with affordable material and courses in investing, financial literacy, and business strategies for established enterprises and start-ups. Developed by author, speaker and semiar leader Paul Mladjenovic, his more than 40 years experience will help you navigate the economy in these uncertain times. Check out his books.

Click on this link to obtain your copy of the Home Office Tax Cut that pays for itself many time over.

*******************************************************************************************************

Joseph Cotto and I discuss the economy on his podcast.

Tom DiLorenzo’s pamphlet, Axis of Evil, is now available at the Mises Institute.

Order a free copy of Rothbard’s money and banking classic monograph. Or, you can read it online here.

My December 10 talk on medical care.

Bob Murphy interviews Dr. Keith Smith of the Surgery Center of OK.

****************************************************************

Murray Sabrin, PhD, is emeritus professor of finance, Ramapo College of New Jersey. Dr. Sabrin is considered a “public intellectual” for writing about the economy in scholarly and popular publications. His book, The Finance of Health Care: Wellness and Innovative Approaches to Employee Medical Insurance (Business Expert Press, Oct. 24, 2022), and his other BEP publication, Navigating the Boom/Bust Cycle: An Entrepreneur’s Survival Guide (October 2021), provides decision makers with tools needed to help manage their businesses during the business cycle. Sabrin's autobiography, From Immigrant to Public Intellectual: An American Story, was published in November, 2022. He is also the author of Why the Federal Reserve Sucks.

Murray - I’ll never forget the day in 1995 in your office at Ramapo when you threw a copy of Tax Free 2000 in with the pile of books I was taking off your hands. “Read this. It’s on the house” you said to me. And I actually did read it and the transformation from a typical liberal idiot into a critical thinker began.

Now 30 years later, it seems like the world is finally catching on to what you and Rothbard, along with many others like R Paul, Rockwell etc have been warning us about. Tyranny is a lot closer than the deceiving media would have us believe. There’s a long way to go in what I see as American Revolution 2.0 (probably many years after we’re long gone) but at least we are part of the beginning. And hopefully we can move forward without a lot of violence.

Take care

Jeff

Absolutely, Mr. Sabrin! Abort the IRS and all income tax!