Politics, inflation, and more

The GOP can flip the Senate in the next few days. Has inflation peaked? And last chance to download for free the Kindle version of my autobiography

The GOP lost one Senate seat in the November election instead of picking up any seats, because John Fetterman beat Republican Dr. Oz in Pennsylvania, flipping the seat held by Republican Pat Toomey. The Democrats now hold a 51 to 49 advantage. However, Arizona Democratic Senator Krysten Sinema recently announced she registered as an Independent, but will still caucus with the Democrats just like Independents Bernie Sanders and August King.

West Virginia Democrat Joe Manchin, who is up for reelection in 2024 in the reddest state in the country, West Virginia, recently said he is remaining a Democrat for the time being.

Republicans could shake up the Senate if they aggressively recruit Sinema to caucus with the GOP, while encouraging Manchin to switch parties or become an Independent and caucus with them. This may be a long shot but it would be worth trying to control the Senate even after the GOP had one of the worst midterm elections in modern history given the issues that favored a “Red tsunami.”

What would it take to have both Sinema and Manchin join the GOP caucus? I would think both senators could be enticed to cross the aisle if they were given their choices to head one of the Senate committees that would help their respective states. They could choose from the following list. I would think Sinema would be interested in Homeland Security, because she represents a border state and Manchin would love to head the Energy and Natural Resources because his state is an energy producer.

We will soon know if the GOP Senate leadership has any smarts. The GOP is not called the Stupid Party for nothing.

****************************

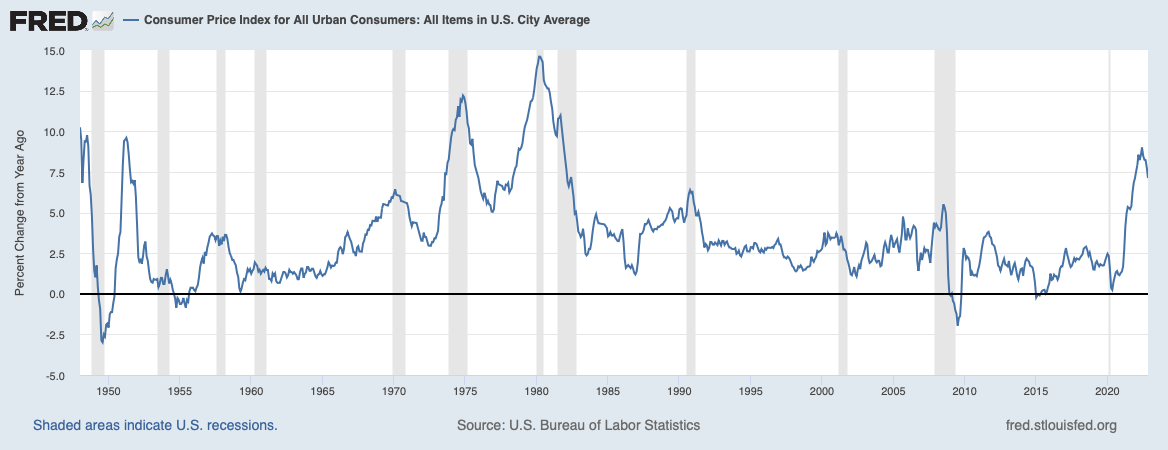

The Consumer Price Index appears to be moderating from its first half of the year torrid pace. Whether the rate of price increases is just taking a breather before another upward move remains to be seen. But given the “stickiness” of prices—especially services, we could see much higher price inflation than the Federal Reserve’s 2% target for several years.

The last inflation cycle lasted from the mid 1960s to the early 1980s. The gray bars indicates when the economy was in recession, which is correlated with price deceleration.

Last year I forecast a recession would begin in the second half of 2023. That forecast seems to be on target, given that the yield curve that I follow is signaling a recession in 2023. The 10 year Treasury rate minus the 3 month T-bill rate is screaming recession next year.

In the meantime, the Fed raised the fed funds rate another half point on Wednesday, in line with expectations. Still, the fed funds rate is below the inflation rate, indicating that borrowing money is not “painful” for both consumers and businesses. In previous recessions, the fed funds rate rose above the inflation rate, which may sill happen next year. Stay tuned.

***************************

Friday is the last day to download the Kindle edition of my autobiography for free. Otherwise the price is only $3.99, which is a virtually free. This morning my autobiography is #1 in two categories

Do repubs matter anymore? They did little to refute the covid pandemic and the following mRNA injection parade. The leftists easily painted the red wave with black...which is their national color.

Inflation ebbs and flows. I doubt we have seen the high. The Fed does not matter anymore, if they ever did.