Trump's tariffs ruled unconstitutional. Will the Supreme Court concur? Gold soars. Sovereign wealth fund = socialism.

Tariffs are taxes and only the Congress can raise tariffs or taxes.

Please help me reach the goal of 100,000 subscribers by January 1, 2026. Please forward this post to family, friends, colleagues, and neighbors. The goal is to help spread the ideas of peace, economic freedom, and civil liberties. If every subscriber can recruit 9 new subscribers who in turn invite 10 others to become a member of the most important initiative to restore the republic, MAFI, then we will leave a lasting legacy for future generations.

New free book from the Mises Institute.

*************************************************************************

Last Friday the Court of Appeals in a 7-4 ruling opined that the Trump tariff hikes are unconstitutional. The Trump administration will seek an expedited Supreme Court decision hoping it will uphold the president’s tariff hikes, which has brought in tens of billions of tax dollars since he instituted them earlier this year.

American businesses and consumers pay the tax. Make no mistake about it, foreign countries do not pay the tariffs, they come out of the pockets of Americans.

The Supreme Court will make the final determination if Trump has the authority to impose tariffs unilaterally. The WSJ editorial, “Trump Isn’t a Tariff King,” concluded correctly, “If he can impose a tax on any imported product any time he wants, he really has the power of a king. The lower courts are doing their duty, and soon it will be up the Supreme Court.”

If the Supreme Court rules in Trump’s favor, then he and future president will have unchecked power to interfere in the economy.

Whatever is left of the free enterprise system would go into the dustbin of history.

Does Trump want his legacy to be the end of the market economy in the country? I don’t think the Trump team has thought this one through.

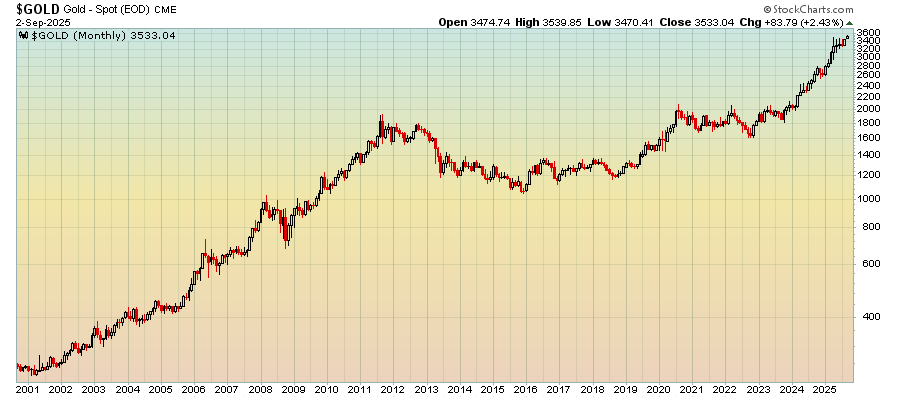

The price of gold hit another all time high today, reflecting a myriad of concerns, not the least of which is the US national debt, a bloated federal budget, a probable US economy slowdown, entrenched inflation, and more money printing.

In the first decade of the 21st century the price of gold soared to $2,000 per ounce, then essentially went “sideways” for more than a decade. Gold “broke out” last year and has increased by nearly $1,500 per ounce, making the yellow metal one of the best performing assets in the world.

What’s next for the gold price? Short-term anything is possible. However, if current trends continue we could see replay of the 8x increase in the price of gold from 2000 to 2011, which would take the price from $2,000 to $16,000 per ounce in the next decade.

This is not a forecast or a prediction by any means. We are in uncharted territory and the unfolding financial crisis could cause a global run on paper money.

Trump wants the US to create a sovereign wealth fund, a euphemism for socialism.

What could possibly go wrong when politicians control trillions of dollars of assets?

Can anyone say CORRUPTION and misallocation of resources?

Trump’s obsession with interfering in the economy is taking the GOP to the left of the Democrats? Did Trump voters choose a Bernie Sanders clone?

*****************************************************************************

Three new essays about MAFI, abolishing the income tax and nonprofitization.

https://cloutstars.com/murray-sabrins-strategy-to-end-taxes-and-supercharge-american-philanthropy/

https://futuremillionairesmagazine.com/from-professor-to-public-advocate-how-murray-sabrin-is-fighting-for-financial-freedom/

*****************************************************************************

Murray Sabrin, PhD, is emeritus professor of finance, Ramapo College of New Jersey. Dr. Sabrin is considered a “public intellectual” for writing about the economy in scholarly and popular publications. He is also an Associated Scholar at the Mises Institute. His book, The Finance of Health Care: Wellness and Innovative Approaches to Employee Medical Insurance (Business Expert Press, Oct. 24, 2022), and his other BEP publication, Navigating the Boom/Bust Cycle: An Entrepreneur’s Survival Guide (October 2021), provides decision makers with tools needed to help manage their businesses during the business cycle. Sabrin's autobiography, From Immigrant to Public Intellectual: An American Story, was published in November, 2022. He is also the author of Why the Federal Reserve Sucks.