Why politicians love inflation

The Federal Reserve’s money printing is manna from heaven for governors

Note: If you become an annual subscriber by January 31, you will receive an autographed copy of my memoir.

Despite what you hear from Joe Biden and administration officials about “fighting inflation,” politicians across the political spectrum just love the tax money that flows into state treasuries during an upswing in the inflation cycle.

David Lieb’s AP article, “State banking big bucks as Fed attempt to fight inflation,” was picked up by newspapers across the country the other day, and reveals how both Republican and Democratic governors and state chief financial officials are just giddy over the windfalls their states have received because of the Fed’s easy money policies.

The Fed’s easy money polices, which is also known as quantitative easing, took a great leap forward during 2020 when the lockdowns ignited a federal spending orgy by the Trump administration. When the federal government spends more money than it collects in taxes, it could raise taxes to cover the shortfall and/or the Treasury could issue debt to balance the budget. In other words, the federal budget is always “balanced.”

What matters is how the budget is balanced.

If the Treasury issues debt, then money flows form savers to the federal government without an increase in the money supply. In other words, deficits financed by borrowing are not inflationary because purchasing power is transferred from the private sector to the government.

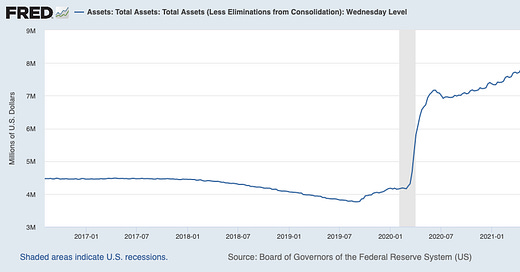

In 2020, the Federal Reserve created trillions of new dollars by buying government debt and mortgage-backed securities, which has fueled the spike in housing prices throughout the country. See. Fig. 1.

Fog. 1.

The increase in the Fed’s balance sheet translated into a huge rise in the M2 money supply (Fig. 2).

According to the Federal Reserve:

Before May 2020, M2 consists of M1 plus (1) savings deposits (including money market deposit accounts); (2) small-denomination time deposits (time deposits in amounts of less than $100,000) less individual retirement account (IRA) and Keogh balances at depository institutions; and (3) balances in retail money market funds (MMFs) less IRA and Keogh balances at MMFs.

Beginning May 2020, M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1.

The bottom line is that the new money enters the economy via the financial system and then we see some consequences soon, rising stock and bond markets and a real estate boom. Soon thereafter rising prices and wages kick in, to the delight of local and state politicians because higher nominal wages and prices means more tax dollars for them to spend and/or cut tax rates or provide property tax relief.

But there is trouble in paradise. The Fed is selling mortgage-backed securities and Treasuries, effectively reducing the amount of money in the economy to deal with the highest inflation rate in 40 years. The stock and bond market declines this year have taken it on the chin. Less money creation translates into lower stock and bond prices. The financial markets thrive when money is easy and inflation is low. Now we have “tight” money, higher interest rates and uncertainty in the financial markets as to how much longer the Fed will unwind its balance sheet and how high short term interest rates will rise.

State budget surpluses are beginning to decline and in California’s case becoming a deficit. So, the “good times” are ending for the time being, until the Fed pivots and begins to inflate again to deal with the next recession.

To end the cycle of boom and bust, we must abolish the Federal Reserve. Murray Rothbard’s book, The Case Against the Fed, is indispensable reading for all Americans. Central banking is in the final analysis an enemy of the working class and a boon to the proponents of the welfare-warfare state. Without the Fed the size of the federal government would be a fraction of what it is today. The Fed is thus the enabler of the military-industrial complex, endless wars, and entitlements.

HAPPY NEW YEAR AND WISHING YOU PEACE AND PROSPERITY FOR 2023

Murray Sabrin, PhD, is emeritus professor of finance, Ramapo College of New Jersey. Dr. Sabrin is considered a “public intellectual” for writing about the economy in scholarly and popular publications. His new book, The Finance of Health Care: Wellness and Innovative Approaches to Employee Medical Insurance (Business Expert Press, Oct. 24, 2022), and his other BEP publication, Navigating the Boom/Bust Cycle: An Entrepreneur’s Survival Guide (October 2021), provides decision makers with tools needed to help manage their businesses during the business cycle. Sabrin's autobiography, From Immigrant to Public Intellectual: An American Story, was published in November, 2022.