Will the Federal Reserve interfere in the 2024 election?

If the Fed lowers interest rates next year, it will reveal the fix is in to help Biden or whoever is the Democrat’s presidential nominee win the election.

I am pleased to announce that I will be team teaching The Economics of Healthcare and Wellness—Focus on Transformative Solutions beginning on January 17th.

You can register by scrolling down to view the syllabus and course fee. The course is sponsored by IPAK-EDU, an online education organization with dozens of courses taught by experts in various scientific and other fields.

In 1972 then Fed Chairman Arthur Burns goosed the money supply to help President Nixon win reelection after the president imposed wage-price controls and severed the last link between the dollar and gold. Nixon’s interventionist policies set the stage for double digit inflation and the stagflation of the 1970s.

According to Mickey Levy in a Wall Street Journal op-ed today, the Fed will not “boost Biden” in 2024 like Burns “boosted” Nixon in 1972. However, in his essay Levy omits the most recent egregious Fed hewing to a president’s request for lower interest rates before a presidential election.

Since the Great Recession the Fed kept rates close to zero to boost the economy, and the Fed then began the slow process of raising getting rates to “normalize” them. By the fall of 2019, the Federal Reserve had been raising interest rates for several years. President Trump then went on a rant against Fed Chairman Powell, asserting he has “no ‘guts,’ no sense, no vision!”

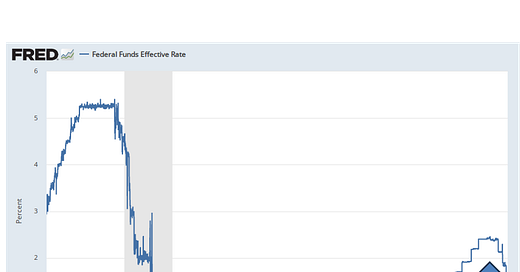

In short, Trump not only did not want the Fed to raise interest rates more going into the 2020 election, but he also wanted the Fed to lower rates. The chart below reveals the Fed did do what Trump wanted. The arrow pinpoints when the Fed lowered rates a few months before the initial Trump Covid lockdowns shutting down most of the US economy. In response, Trump opened the federal spending spigot and the Fed created trillions of dollars to “stimulate” the economy.

Trump’s last year in office was a disaster. He badgered the Fed to lower interest rates. He let Fauci and the other “medical experts” in the federal government run the country’s healthcare system, to the detriment of the public’s health. He also was responsible for “operation warp speed” that gave us a bioweapon disguised as a vaccine. He spent additional trillions of dollars that were borrowed increasing the national debt. During his administration the national debt rose from nearly $20 trillion to $28 trillion by the time he left the presidency in January 2021.

Trump was anything but a fiscal conservative who also was clueless about the Covid “threat.”

Going into 2024, the Fed appears ready to lower interest rates--the long awaited “pivot”—to pour money into the economy to do what exactly? Keep stock prices high, unemployment low, and the economy humming along as Election Day nears.

The Federal Reserve’s manipulation of the economy continues to be a destabilizing force. The fed must stop raising and lowering interest rates and leave rates to be determined by the market.

“There is a right way and a wrong way, always choose the right way.” Abraham Sabrin (1914-2001) “Prediction is very difficult, especially if it’s about the future!” Niels Bohr

Every Wednesday at 11:05am talk show host Gary Nolan and I discuss the economy and politics. The Fort Myers Mises Circle presentations are available online.

Latest podcast on healthcare with host Johnathan Westover; Incentivizing wellness podcast with Bernadette Pajer; the Human Action podcast with Bob Murphy; Joseph Cotto and I discuss Argentina and the US; Perry Atkinson and I discuss the US economy.

****************************************************************

https://fortune.com/2023/03/27/recession-2023-layoffs-tech-finance-unemployment-outlook-fed-rates-murray-sabrin/?utm_source=search&utm_medium=advanced_search&utm_campaign=search_link_clicks. This is an update of my 2021 forecast, https://fortune.com/2021/12/09/next-recession-heres-everything-bubble-markets-2021-2022-covid-murray-sabrin/

***************************************************************

Murray Sabrin, PhD, is emeritus professor of finance, Ramapo College of New Jersey. Dr. Sabrin is considered a “public intellectual” for writing about the economy in scholarly and popular publications. His new book, The Finance of Health Care: Wellness and Innovative Approaches to Employee Medical Insurance (Business Expert Press, Oct. 24, 2022), and his other BEP publication, Navigating the Boom/Bust Cycle: An Entrepreneur’s Survival Guide (October 2021), provides decision makers with tools needed to help manage their businesses during the business cycle. Sabrin's autobiography, From Immigrant to Public Intellectual: An American Story, was published in November, 2022.

The fascist democrats and wacko globalists already have that covered. The financial system is so whacked out of shape from Fed interventions over the last 40 years, that it will never know any saneness or mesh with reality. Doesn't matter since it's going to be burned to the ground within the next 10 years.